Stainless Steel Pipes latest news and Exports

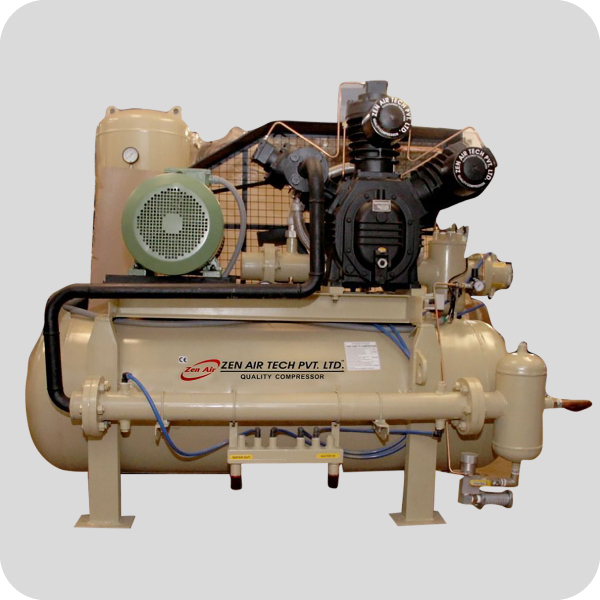

February 24, 2023Air Compressors Exporter.

Air Compressors.

1. Air Compressor demand remains High.

The industry for Air Compressor keeps growing. Undoubtedly, the global market for industrial air compressor is expected to reach $42.9 billion by 2026, up from $32.7 billion in 2021 – a 5.6% annual growth rate. Much of the global demand growth for air compressor can be attributed to rising rates of industrial automation in developing countries. However, demand is increasing in the United States as companies expand local manufacturing capacity and "reshore" overseas operations. After two years of global supply chain disruptions, we expect these trends to continue as manufacturers build more local capacity to increase resiliency. We've seen an increase in demand for our products in line with these global and national trends. In fact, compressors are blowing up.

2. Mainly Steel parts, Lead Times Remain Longer than Normal.

Almost all industries' supply chains have been disrupted, resulting in longer lead times for parts and equipment. The ongoing steel shortage has had the greatest impact on the compressed air industry. The steel industry, like many others, was disrupted by the COVID-19 pandemic, resulting in lower output in 2020 and 2021. As steel mills try to ramp back up to meet increased demand, this has caused ripple effects throughout the manufacturing industry. This has a direct impact on the availability of steel-heavy components like air receiver tanks, air pumps, and even oil filters. Because of steel shortages, piston (reciprocating) compressors have been more likely to suffer production delays.

The ongoing computer chip shortage has also had an impact on the industrial air compressor industry. While the compressor industry is not as chip-heavy as the automotive or aerospace industries, many industrial air compressors, such as Variable Speed Drive (VSD) compressors, do require chips for control systems. Other parts shortages (belts, gaskets, etc.) have not been as widely spread, but have occasionally been a local issue. When a single component, such as a fan, is unavailable, production for entire compressor systems is brought to a halt until the part can be procured.

All of this means that industrial air compressors will have longer lead times. Compressors that used to have lead times of 2-4 weeks may now have lead times of 6-8 weeks. Over the last year, we've seen lead times of up to 18 weeks for VFD compressors. Finding replacement parts for air compressors has also become more difficult for many manufacturers. We anticipate some ongoing challenges in this area through the first half of 2023. If you know you'll need an air compressor in the coming months, don't put it off until the last minute; place your order as soon as possible.

3. Rebalancing Compressed Air Supply Chains and Prices.

What's the good news? Supply chains and pricing are beginning to stabilise, and prices for parts and consumables may even begin to fall. As we approach 2023, we're seeing supply and demand rebalance and supply chains smooth out. That means fewer unexpected disruptions in 2023, more inventory on hand, and (eventually) shorter lead times. It could even result in inventory surpluses for some air compressor manufacturers who overproduced to compensate for recent shortages.

All of this should lead to improved price stability. Most suppliers have had to raise their prices in the last two years, and Fluid-Aire Dynamics is no exception. While we have done everything possible to keep prices low, we have had to make some adjustments in the last 18 months as a result of rising prices in a variety of categories, including compressor equipment, parts, lubricants, freight, labour, vehicles, and fuel. While we don't expect prices to fall significantly (if at all), we also don't expect them to rise at higher-than-normal rates.

4. Industrial Internet of Things (IIoT) Applications Are Coming for Air Compressors.

Enough about supply chains; what else is going on in the compressed air world? While the industry as a whole hasn't changed much in the last few decades, we're starting to see more "smart" machines and cloud-based compressed air applications. There is particular interest in cloud-based remote monitoring and control for compressed air equipment. The market for connected, smart air compressors is part of the larger "Industrial Internet of Things" (IIoT), which is making manufacturing more efficient and responsive. Remote monitoring and control technologies for air compressors could soon assist manufacturers in identifying emerging equipment problems, saving energy costs, centrally managing air compressor banks, and optimising maintenance plans to reduce costs and downtime. Watch this space for updates.

We serve better!

Know more about us!

Need a quick help or have questions?

Opening hours

Monday - Friday

09:30 AM - 07:00 PM

Saturday

09:30 AM - 06:00 PM

Locate us

Arham Tradelink

12 No. Ground floor, Opposite Gurudwara, Odhav Road - Ahmedabad [Gujarat]-INDIA 382415

Jan 21, 2023

Take the stones people throw at you & use to build a monument.

– Ratan Tata.